Automated ICT 2025 Trading Bot Using Smart Money Concepts

Institutional-grade trading increasingly depends on automation, data quality, and consistent execution. This guide presents a professional-grade ICT (Inner Circle Trader) 2025 trading bot that operationalizes Smart Money Concepts using an n8n workflow. The solution combines session-aware signal validation, Coinbase market data, and GPT-4o analysis to create an end-to-end pipeline for trading signal intake, evaluation, execution, and reporting via Telegram and Notion.

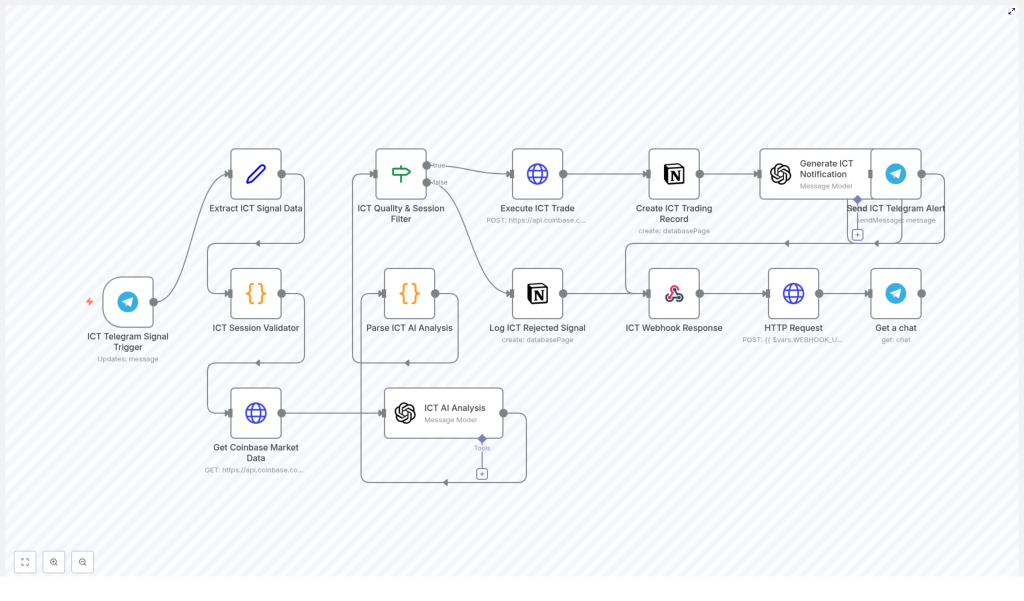

Architecture Overview: ICT Smart Money Workflow in n8n

The workflow is implemented as a modular n8n template that connects messaging, market data, AI analysis, and execution services. It is designed for automation professionals who require a transparent, auditable, and extensible trading system.

At a high level, the workflow performs the following functions:

- Receives ICT-based trading signals from Telegram

- Extracts and normalizes all key signal parameters

- Validates signals against ICT kill zones and session logic

- Enriches signals with real-time Coinbase market data

- Runs an AI-driven ICT analysis using GPT-4o

- Applies quality and session filters before execution

- Places trades on Coinbase when conditions are met

- Logs trades and rejected signals to Notion

- Sends structured Telegram notifications to the user

This design separates concerns across multiple nodes, which simplifies maintenance, testing, and future enhancements.

Core Nodes and Data Flow

1. ICT Telegram Signal Trigger

The workflow starts with an ICT Telegram Signal Trigger. This node listens to a specified Telegram channel or bot and captures incoming ICT trading signals in real time. These signals typically include:

- Technical indicators (e.g. RSI, MACD, volume)

- Trading symbol or pair

- Intended action (BUY or SELL)

- Entry or reference price

- Timestamp of the signal

By centralizing the trigger on Telegram, the workflow can be integrated with existing ICT signal providers or proprietary signal-generation systems.

2. Extract ICT Signal Data

The Extract ICT Signal Data node parses the raw Telegram message and structures it into a clean, machine-readable format. This parsing step typically includes:

- Extracting indicators such as RSI, MACD, and volume

- Capturing the trading symbol and direction (BUY or SELL)

- Normalizing price and time values

- Preparing a standardized payload for downstream nodes

Standardization at this stage is critical for reliable validation, AI analysis, and execution logic.

3. ICT Session Validator

The ICT Session Validator node applies ICT-style session logic using GMT-based kill zones. It classifies the signal based on whether it occurs within high-probability trading windows, such as:

- Asian session

- London session

- New York session

In addition, this node enriches the signal with metadata such as:

- Session label (e.g. London, New York)

- Session strength or relevance

- Session priority for risk management and AI evaluation

This structured session context is essential for ICT Smart Money Concepts, since many setups are highly session-dependent.

4. Get Coinbase Market Data

The Get Coinbase Market Data node connects to Coinbase and retrieves real-time information for the target symbol. Typical data points include:

- Current market price

- Recent price movements and volatility context

- Order book or relevant market metrics (depending on your implementation)

By enriching the signal with live market data, the workflow enables more accurate AI analysis and more informed trade execution decisions.

5. ICT AI Analysis (GPT-4o)

The ICT AI Analysis node leverages GPT-4o to perform a structured, ICT-focused assessment of the signal. Using the parsed signal, session metadata, and Coinbase data, the AI produces:

- Signal quality classification (HIGH, MEDIUM, LOW)

- Confidence score on a 0-100 scale

- Risk level and directional recommendation (BUY, SELL, HOLD)

- Evaluation of key ICT Smart Money factors, such as:

- Session alignment with ICT kill zones

- Market structure and trend context

- Liquidity grabs and stop hunts

- Fair value gaps and imbalances

- Institutional or smart money sentiment

This node effectively acts as an AI-based ICT analyst that standardizes decision-making and reduces discretionary variance.

6. ICT Quality & Session Filter

The ICT Quality & Session Filter node is a decision gateway that applies strict criteria before any trade is allowed to progress to execution. Typical checks include:

- Minimum AI confidence threshold

- Required signal quality (for example, only HIGH or MEDIUM)

- Valid and active ICT session alignment

Only signals that meet both quality and session requirements continue to the trade execution path. All others are routed to a rejection and logging flow. This enforces disciplined trading behavior and supports robust risk management.

7. Execute ICT Trade

When a signal passes the filters, the Execute ICT Trade node interacts with Coinbase via its API to place an order. In a typical configuration, this node:

- Places a market order aligned with the recommended direction

- Uses predefined position sizing or quantity parameters

- Respects your configured risk parameters

Execution is fully automated, which eliminates latency and manual errors that frequently occur during volatile market conditions.

8. Create ICT Trading Record (Notion)

Every executed trade is recorded by the Create ICT Trading Record node in a Notion database. The log generally includes:

- Signal parameters and indicators

- Session metadata

- AI analysis summary and confidence score

- Executed trade details from Coinbase

- Timestamps and any additional notes

This persistent record supports transparency, performance review, backtesting of decision criteria, and compliance reporting where needed.

9. Generate ICT Notification & Send Telegram Alert

To keep traders informed in real time, the Generate ICT Notification & Send Telegram Alert node formats a professional, human-readable message summarizing the action taken. This notification can include:

- Symbol, direction, and execution price

- Session classification and quality rating

- AI confidence and risk summary

- Links or references to the Notion record

The message is then dispatched via Telegram, enabling rapid situational awareness without the need to manually monitor the workflow.

10. Log ICT Rejected Signal

Signals that do not pass the quality or session filters are not discarded silently. Instead, the Log ICT Rejected Signal node stores them for future analysis. This archive can be used to:

- Refine filter thresholds and criteria

- Identify patterns in low-quality or poorly timed signals

- Improve upstream signal generation logic

Systematically logging rejections is a best practice for continuous improvement of automated trading systems.

Benefits of Automating ICT Smart Money Trading with n8n

Implementing this ICT 2025 trading bot as an n8n workflow delivers several advantages for professional traders and automation engineers:

- Operational Efficiency

Automated parsing, validation, and execution eliminate manual handling of signals and reduce timing errors, especially around session opens. - Consistent Application of ICT Principles

Rules are applied uniformly, without emotional bias, which is particularly important for Smart Money Concepts that depend on disciplined execution. - Data-Enriched Decision-Making

The combined use of real-time Coinbase market data and GPT-4o analysis results in richer, more context-aware trade decisions. - Structured Risk Management

Quality and session filters prevent low-confidence or off-session trades from being executed, which supports capital preservation. - Real-Time Transparency

Telegram notifications and Notion logging provide clear visibility into every decision, both executed and rejected. - Extensibility and Control

Built on n8n, the workflow can be customized, versioned, and integrated with additional tools such as dashboards, CRMs, or analytics platforms.

Implementation Guide: Getting Started with the Template

To operationalize this ICT Smart Money workflow, follow these steps:

- Deploy the Workflow in n8n

Import the provided template into your n8n instance. Review each node to understand its purpose and ensure it aligns with your infrastructure and compliance requirements. - Configure Coinbase Advanced API Access

Set up secure credentials for Coinbase Advanced in n8n. Confirm that your API keys have the appropriate permissions for market data retrieval and trade execution, and store them using n8n’s credentials management for security. - Set Up Telegram Integration

Create or configure a Telegram bot and connect it to the relevant channel for receiving ICT signals. In n8n, configure the trigger and notification nodes with your bot token and chat IDs for both input and output messages. - Define Risk and Position Parameters

Adjust quantities, trade sizes, and any risk-related parameters in the execution node. Align these settings with your overall risk management framework and account size. - Customize Filters and AI Thresholds

Tune the ICT Quality & Session Filter node to match your tolerance for risk and preferred trading conditions. This may include setting minimum confidence scores or restricting trades to specific sessions. - Monitor Logs and Optimize

Regularly review Notion trade records and rejected signal logs. Use these data points to refine your filters, AI prompts, and session definitions as market conditions and your strategy evolve.

Strategic Perspective and Next Steps

Combining ICT 2025 Smart Money Concepts with AI-driven analysis and real-time exchange data represents a significant evolution in algorithmic trading workflows. By automating signal intake, evaluation, and execution in n8n, you gain:

- Higher precision in timing and execution

- Improved consistency in applying ICT rules

- Actionable insight from structured logs and AI outputs

If you are ready to operationalize ICT Smart Money Concepts with a production-grade automation stack, this template provides a robust foundation. Integrate it into your environment, align it with your risk parameters, and iteratively refine it using real performance data.

Leverage advanced trading automation to stay ahead of the market, reduce operational friction, and make more informed, data-driven trading decisions.